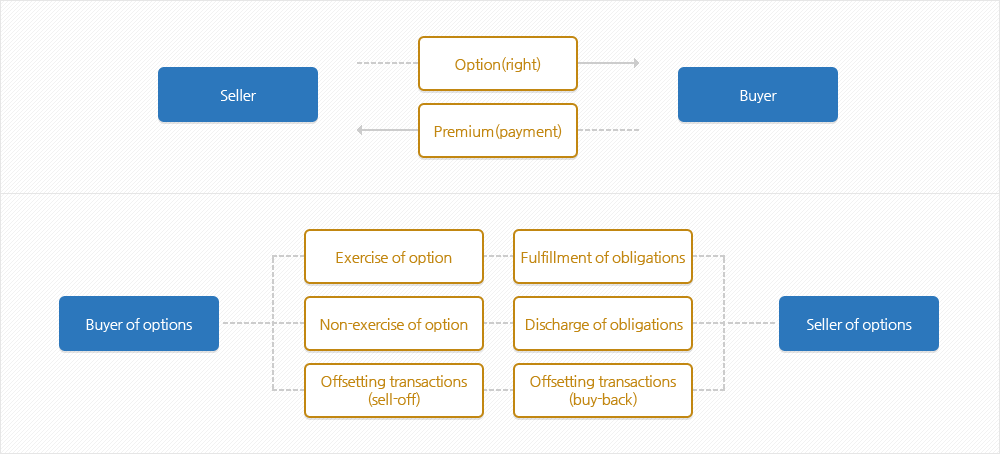

- Options transactions have specific settlement methods such as exchange of option (right) against premium (payment), offsetting transactions and exercise of options and non-exercise of options.

-

Sellers of options endow to the buyer the right to sell or buy at the exercise price on the last trading day. In return, the seller receives premium from the buyer. The buyer, the holder of the right, can choose either way of the offsetting transaction, exercise of the right or non-exercise of the right. The seller, however, as the obligor, can choose only an offsetting transaction to be discharged from the obligation.

For the trades between members and their customers, the settlement deadline is 12:00 of the next day and the settlement deadline for the trades between members and the exchange is 16:00 of the next day.