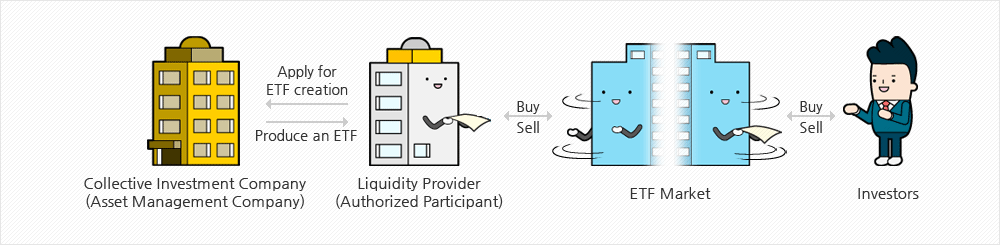

The ETF market is divided into the primary market where ETFs are issued and redeemed and the secondary market where ETF securities are listed and traded. As creation or redemption of ETFs is made in Creation Units (CUs) in the primary market, only corporative investors can usually participate in the market. When investors want to create ETFs in the primary market, they takes over the ETFs by paying the stock basket required to create the ETFs via investment companies and agencies designated as an Authorized Participant (AP), and on the other hand, when they want to redeem ETFs, they pay the ETFs and take over the stock basket. ETFs should issue beneficiary certificates when they are asked to issue new shares or respond to requests for redemption. Creation of ETFs, issue of new shares and redemption are allowed 'in kind' like shares, which correspond to the Portfolio Deposit File (PDF) as of the day of its announcement by the collective investment company.

Unlike other collective investment vehicles, ETFs can reduce fund management costs and track the yields of the indexes they follow as accurately as possible as they are created and redeemed in kind. This is intended to minimize the possibility of errors through creation of ETFs, issue of new shares and redemption basically in kind so that ETFs can meet their original goal of following the index return.