EXTURE+ Trading, the State-of-the-Art technology of KRX, is at par with global competitive trading platforms.

EXTURE+ Trading is the result of an endless effort to achieve a Zero(0) Latency Matching Engine.

Major advantages of EXTURE+ Trading

- All in a Single Platform(stocks, bonds, futures, options, ETFs, warrants, commodities, etc.)

- Memory-based solution and open source architecture

Provides trading related functionalities which are required for traditional equity instruments(stocks, ETFs, ELWs, warrants, beneficiary securities) and bond instruments(government bonds, local government bonds, monetary to derivatives, it supports futures/options on various assets ranging from stock index, currency, interest, metal, agriculture and so on.

Enables to support basic functions required for the multi-markets, multi-instrument types, participant and user management in accordance with a variety of trading rules applicable such as trading session, multi-trading board, tick size management, order type management, block trade(negotiated deal), order amendment, corporate actions and monitoring facilities using real-time monitoring trading screen,

Capable of accommodating up-to-date functionalities such as DMA, Non-exchange trading venues(Dark pool, ECN), Algorithmic trading/High frequency trading, Market information broadcasting, foreign ownership tracing, Dual listing and so on.

-

Trading System Table Service Area Detailed Services Instruments Stock Common/Preferred Stock, Mutual Fund, ETF, Warrants, Rights, DRs Securitized Derivatives ELWs Bond REPO Derivatives Futures, Call/Put Options Market Structure Multi-Market Operations of multi and different markets in one exchange Multi-Board Odd-Lot Board, Buy-In Board, Negotiation Board and others Pre-Open, Main and Post-Closing depending on the trading hours. Trading Method Individual Auction Single Price Auction, Continuous Matching, Allocation Matching, One-Side Auction Negotiation Order Order Type Limit Order ATO/ATC, Market Order Stop Limit/Market Order, Iceberg Order Same Side Best Order, Opposite Side Best Order Cancel Condition FAS/FAK/FOK Time Condition GTC Trading Rule Price Limit & Tick size per Security type & Board Quantity Limit & Unit per Security Type & Board Order Type & Cancel Condition per Security Type & Trading Session Other Functionalities Designated Flag Applicability of Trading Rule and Trading Schedule Exceptions (User Customizable) New Listing Symbol, Delisting Period Symbol, Last Trading Day Symbol, Warning Symbol Market Maker Market Making Type, Responsibility Type, Notification Message DMA Drop Copy, Risk Filter Automatic Suspension Multi Level Market CB : Cash Market CB, Derivatives Market CB Multi Level Symbol CB Inter-Market, inter-Product, Inter-Instrument Linkage Trading Restriction Short Selling, Margin Order, Treasury Stocks - Superior Performance

- EXTURE+ Trading Capacity & Performance Measurement

Superior performance Table Category EXTURE+ Trading Performance Throughput 100,000+ TPS Latency (Avg) 30~50 μs - Global Compatibility

-

- Overseas investors and solution customers can enjoy easier access to market and rich set of functionality

- Standard Protocol

- FIX/FAST for standard access

- Participants

- DMA Functionalities

- Support several types of Market Making

- Abundant Functionalities

- Support wide range of options for Trading Method, Board Type, Order Type and other categories

- Cost Efficiency

- Provision of Low-Cost Operation System Environment by using Cutting-Edge Technology

Cost Efficiency Table Category Features Benefits Infra x86 Linux Server Faster Upgrade Cycle

Lower Cost InfrastructureTechnology Memory-based Order Book

Layered/Tiered ArchitectureFast Fail-Over with Zero data loss

Flexible Capacity Enhancement at Low Cost - Flexibility

-

- With RDS, Reference Data Service, new Layer/Product/Attribute can be flexibly added without modifying the source code

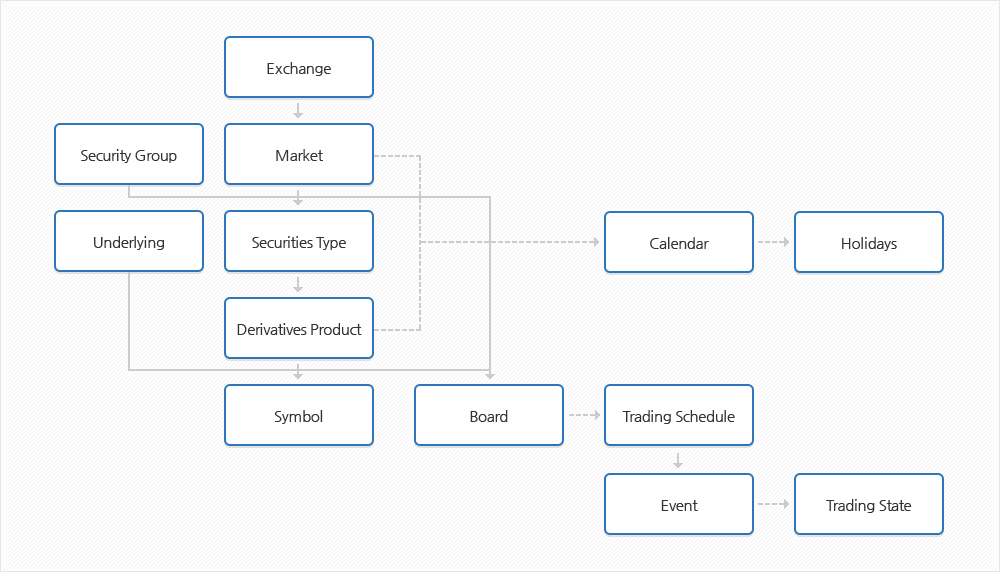

- Product Hierarchy