- Corporations under special provisions

- Any corporation satisfying the requirements below (“corporation with technology rating or a company that has a record of crowd funding”) is allowed to list its shares in the KONEX market without appointing the designated advisor (“Special Exemption Listing”).

- Corporations with technology rating

-

1) Technology Crediting Bureau or Technology valuation institutionCorporations under special provisions Items Requirements Attraction of investment Institutional investors designated by the KRX should hold at least 10% of outstanding shares of the corporation or the amount of investment is worth KRW 3 billion or more for at least 6 months. Technological capacity The corporation should acquire a technology rating higher than certain level by the Technology Credit Bureau (TCB) etc.1) Consent of investors The corporation should obtain the consent on the special exemption listing and lock-in of shares from the designated institutional investors.

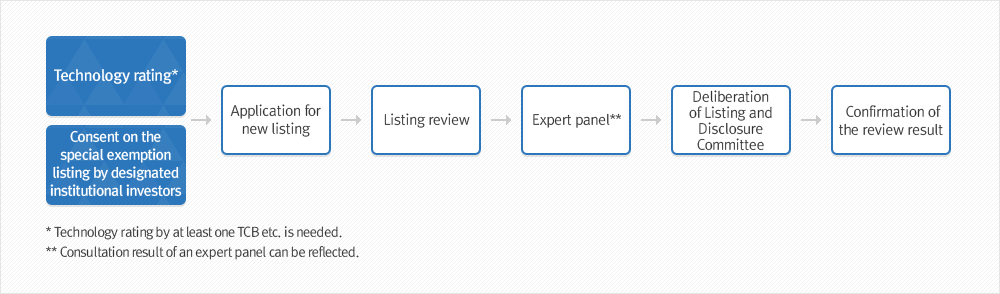

Technology Crediting Bureau or Technology valuation institution Technology Crediting Bureau Korea Tecnhology Finance Corporation, Nice Information Service, and Korea Enterprise Data, Ecredible Technology Valuation Institution Korea Health Industry Development Institute, Korea Institute of Science and Technology Information, Korea Institute of Science and Technology, Korea Evaluation Institute of Industrial Technology, Electronics and Telecommunications Research Institute, Institute for Information & Communications Technology Promotion, Korea Research Institute of Bioscience and Biotechnology - Procedure for special exemption listing

- The review of listing application for the special exemption listing is completed in 45 business days after the listing application date. (In the case of ordinary listing procedure where application of listing is made after appointment of the designated advisor, the review results are confirmed in 15 business days.)

- Administration of corporations listed through the special provisions

-

- Classification of the market section: The corporations listed through the special provisions are placed in the start-up section.

- Appointment of the designated advisor: Corporations listed through the special exemption are required to enter an agreement on appointment of the designated advisor in 1 fiscal year after the listing date, otherwise the listing is terminated.

- Delay of listing transfer through the Fast Track: Corporations listed by the special exemption are eligible for the transfer to KOSDAQ through the Fast Track in one year after entering into the agreement on the designated advisor.

- Safe custody of shares: The sales of shares owned by the designated institutional investors who agreed on the special exemption listing of the applicant corporations are restricted as shown in the table below.

Details Target investors Designated institutional investors who agreed on special exemption listing Lock-in period Sales of shares prohibited for the first 6 months after the listing, and then sales of shares up to 10% of holdingpermitted on monthly basis. Range for sales Sales up to 80% of shares held is permitted before appointing designated advisor. Exemption to sales restriction - Institutional investors holding less than 5% of outstanding shares of the corporation

- Case where the corporation with technology rating appoints the designated advisor

- Listing of crowd-funded corporation

-

- Background

-

Listing of crowd-funded companies was established to promote listing of startups on the KONEX market, which have successfully got a certain amount of fund through investment-based crowd funding (small amount of online public offering) to support sustainable growth of startups in accordance with the government’s crowd funding development plan (announced on Nov.7, 2016)

- Quantitative requirements

-

Quantitative requirements are applied differentially to a company that is successfully crowd-funded, and a company that is successfully crowd-funded before or after being registered on the KRX Startup Market (opened on Nov.14, 2016) and maintaining its registration for a certain period of time. As for a company recommended by a policy finance institution, etc., the requirement of funding scale is applied in a less strict manner.

주의The company should meet the requirements that KRX specifies and at least six months should elapse after registration in the KSM.<Quantitative requirement of crowd funding listing> Classification Ordinary crowd-funded company KSM registered crowd-funded company주의 Size of funding KRW 300 million or more

(100 million or more for a recommended company)KRW 150 million or more

(75 million or more for a recommended company)No. of investors 50 or more

(including two professional investors)20 or more

(including two professional investors) - Qualitative requirements (reasons for disqualifications, etc. regarding public interest and investor protection)

-

As for listing of crowd funding without a designated advisor, as same as listing of companies with technology ratings, KRX evaluates a crowd-funded startup as a whole in the qualitative review on behalf of the designated advisor. Given the characteristics of startups, KRX minimizes the requirements of the qualitative review while focusing on capability for disclosure, such as regular and timely disclosure, and management transparency.

- Control of corporations under special provisions

-

- Dividing corporations under special provisions

-

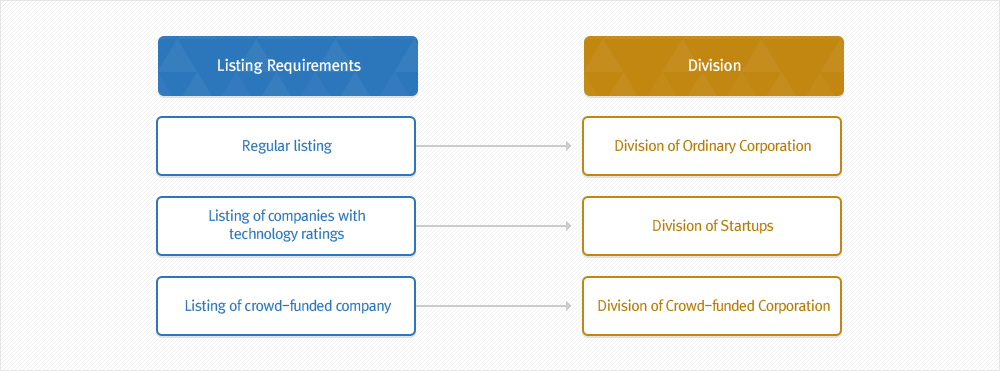

KRX distinguishes between ordinary corporations and those under special provisions.

The Division of Ordinary Corporations is in charge of controlling corporations listed through designated advisors. And the Division of Corporations under Special Provisions, which is responsible for controlling corporations listed without designated advisors, is divided into the Division of Startups and Division of Crowd-funded Corporations depending on the type of listing.

- Listing Requirements Division

- Regular listing Division of Ordinary Corporation

- Listing of companies with technology ratings Division of Startups

- Listing of crowd-funded company Division of Crowd-funded Corporation

- Obligation to appoint designated advisor

-

Corporations listed under special provisions should sign an agreement to appoint a designated advisor and maintain the agreement for a certain period of time starting from the listing date.

주의One year for corporations that belong to the Division of Startups and the Division of Crowd-funded Corporation

If the listed company fails to sign an agreement to appoint a designated advisor after a specified period of time, the listing is aborted. However, if the company files a complaint, delisting may be suspended up to one year after the deliberation by the Listing and Disclosure Committee. - Safe custody

-

A corporation listed under special provisions has a limit on the sales of stocks held by the designated institutional investor who has agreed upon the listing.

Safe custody Classification Specific Requirements Subject Designated institutional investor who has agreed upon listing on the KONEX market Duration Up to 10% of the stocks currently held by the institutional investor mentioned above are allowed to be sold every one month after being restricted from sale for the first six months after listing. Limit Up to 80% of the stocks are allowed to be sold before a designated advisor is appointed.