- Concept of OTC derivatives

-

OTC derivatives refer to the derivatives products of which the transaction is made by negotiation and contract between parties involved in, not via an organized market such as an exchange. On the contrary, the derivatives products with standardized contract terms and listed on an exchange are called Exchange-traded derivatives products.

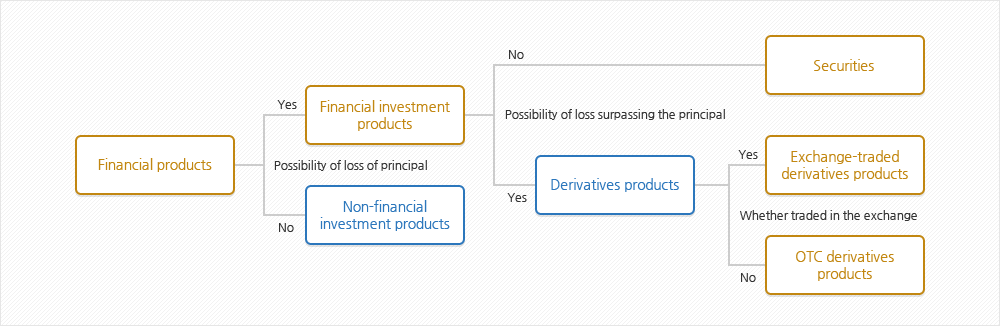

The FSCMA classifies financial investment instruments into securities and derivatives and further categorizes the derivatives into exchange-traded derivatives and OTC derivatives. For OTC derivatives transactions, the FSCMA prescribes matters on the risk management, the investor protection and the compliance requirements of financial investment companies including reporting of trade details to the FSC.

< Classification of Financial Investment Instruments >

- Classification of OTC Derivatives

- Derivatives products can be classified into futures, options, swaps, and forward contracts. Of them, standardized products are usually traded on the Exchange markets whereas non-standardized ones are traded in OTC markets.

- OTC derivatives are classified, according to the underlying assets, as follows:

- Interest derivatives : IRS, FRA

- FX derivatives : CRS, FX forward transactions, NDF, FX swap, currency option

- Equity derivatives : Equity swap, equity option

- Credit derivatives : CDS (Credit Default Swap), CLN (Credit Linked Note)