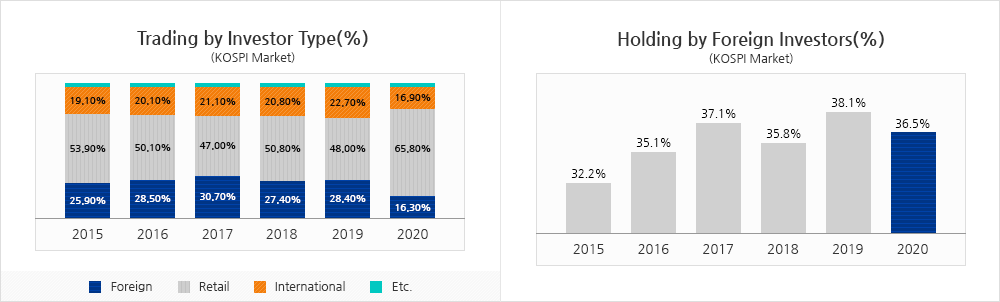

Korean stock market has a well-balanced investor base. Every investor groups ; retail, institutions and foreigners, normally own 30% to 40% of market, respectively, in terms of market capitalization of their portfolio.

Higher liquidity from retail investors and steady participation of local and foreign institutional investors have provided both liquidity and integrity to the market at the same time. Other major Asian and European markets are mainly driven by the institutions and therefore sometimes fail to provide enough liquidity to the market due to the lack of active participation of retail investors. In a nutshell, KRX has combined the higher valuation based on professional expertise of institutional investors with ample liquidity provided by the active retail investors.

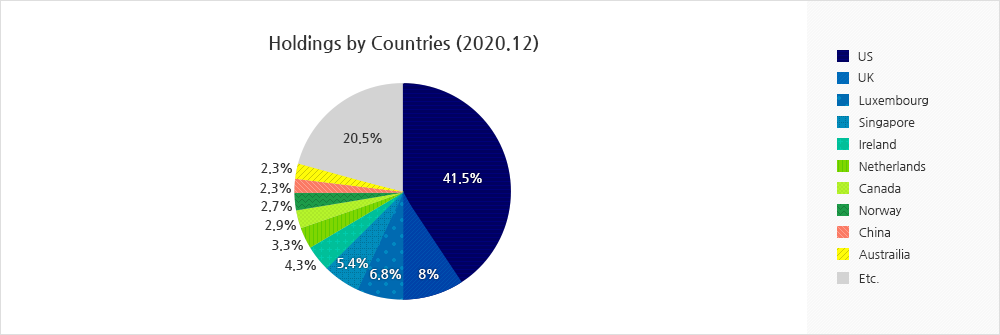

KRX is open market to the world investment community and offers world class connectivity that gives overseas traders greater reach, increased speed of trading and provides better security. Thanks to the robust and resilient Korean economic and corporate fundamentals, more and more foreign investors around the world look to the Korean equity market as a safe and reliable investment venue even in times of global financial turmoil when other emerging countries face difficulties.