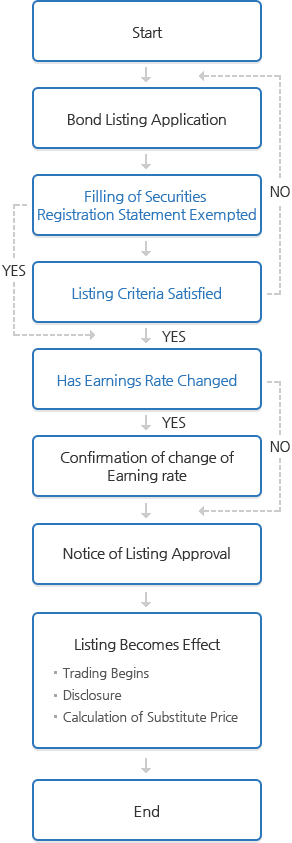

- Listing Procedure

Listing application documents can be submitted by uploading online on the Bond Listing System (http://bonds.krx.co.kr), and the result can also be confirmed on the system.

- Bond Listing System : http://bonds.krx.co.kr

- When to Apply for Listing

- - Bond which is required to file Securities Registration : when the registration is accepted

- - Bond which is exempted from filing of Securities Registration : Before 10th of the month following the issuing month

- Completion of Application : When all required documents are submitted and the listing fee is paid

- Notification Time : Immediately after the confirmation

- Confirmation of listing : Bond Listing System

- Confirmation of standard code : Standard Code System http://isin.sm.krx.co.kr

- Calculation and Application of Substitution Price : Disclosed on the website of KRX and the KOSCOM terminal ("CHECK") on the following day after listing.

- Listing of Government Bonds

-

Government bonds are listed upon receiving the Bonds Listing Request Form, without a listing examination. Treasury bonds and bills are listed on the issuing day. National housing bonds (type 1&2) are listed on the first day of each month according to the application for shelf-listing. Application for listing of treasury bonds and bills are handled by the Bank of Korea over the Internet. For listing of National housing bonds (type 1&2), KRX lists the scheduled quantity on the first day of each month, and adjusts the listing value upon receiving the notice of issuance value following confirmation of bond issuance for the concerned month.

- Listing of Municipal Bonds

-

Municipal bonds are listed without a listing examination considering their public benefit like governments bonds. Provincial development bonds and Metropolitan city subway bonds are handled in the same way as National housing bonds (type 1&2) while public offered bonds are handled in the same way as corporate bonds. Application documents for listing of the former are a shelf-listing application form and the issuance result notification. Those for the latter are a listing application form, trust certificate, underwriting contract or sales contract, a copy of an entrustment contract for public offering (only in case where the concerned bonds are issued through indirect offering), etc. Listing application for bonds can be submitted over the internet

- Listing of Special Bonds

-

주의Special bonds are listed differentially depending on the types of bonds.

- Monetary Stabilization Bonds

In common with government bonds, listing application of the monetary stabilization bonds is made on the day of sale or bidding, and they are listed on the issuing day. - Public bonds

Special bonds prescribed in the Financial Investment Services and Capital Markets Act are issued indirectly through securities firms. For their convenience, the issuing firms are allowed to compile all bonds issued during a month and submit a listing application for such bonds collectively by 10th of the following month. - Financial special bonds and non-financial special bonds

Special bonds are mostly issued indirectly by underwriting institutions, and issuing institutions may apply for listing by 10th of the next month by collecting the bonds issued during the relevant month for convenience. - Shelf-listed bonds

Land and housing bonds are shelf-listed along with Metropolitan city subway bonds. At the end of the year, KRX receives application for shelf-listing of bonds to be issued daily in the following year, lists such bonds on the scheduled date that they have applied, and determines listing prices after being notified of issuing prices of bonds determined to be issued in the concerned month.

- Monetary Stabilization Bonds

- Listing of Corporate Bonds

-

Corporate bonds are listed on the issuing day. Issuance companies submit bond listing application forms to KRX. The listing applications should be submitted after FSC has accepted the Securities Registration Statement.

- Listing of Foreign Bonds

-

Foreign debt securities refer to the debt securities issued by a foreign entity (including the foreign governments, foreign municipal government, foreign public organizations, the foreign corporations established in accordance with foreign laws and regulation and the international financial organizations established according to an international treaties)

Because of difficulties involved in the trustworthiness and/or soundness of foreign corporations, more thorough listing examination is required. Accordingly, in order to ascertain that issuing conditions meet requirements for investor protection and are compatible with the KRX system, anyone who intends to list foreign bonds is required to consult with KRX about the listing procedures or time schedule before submitting a listing application.