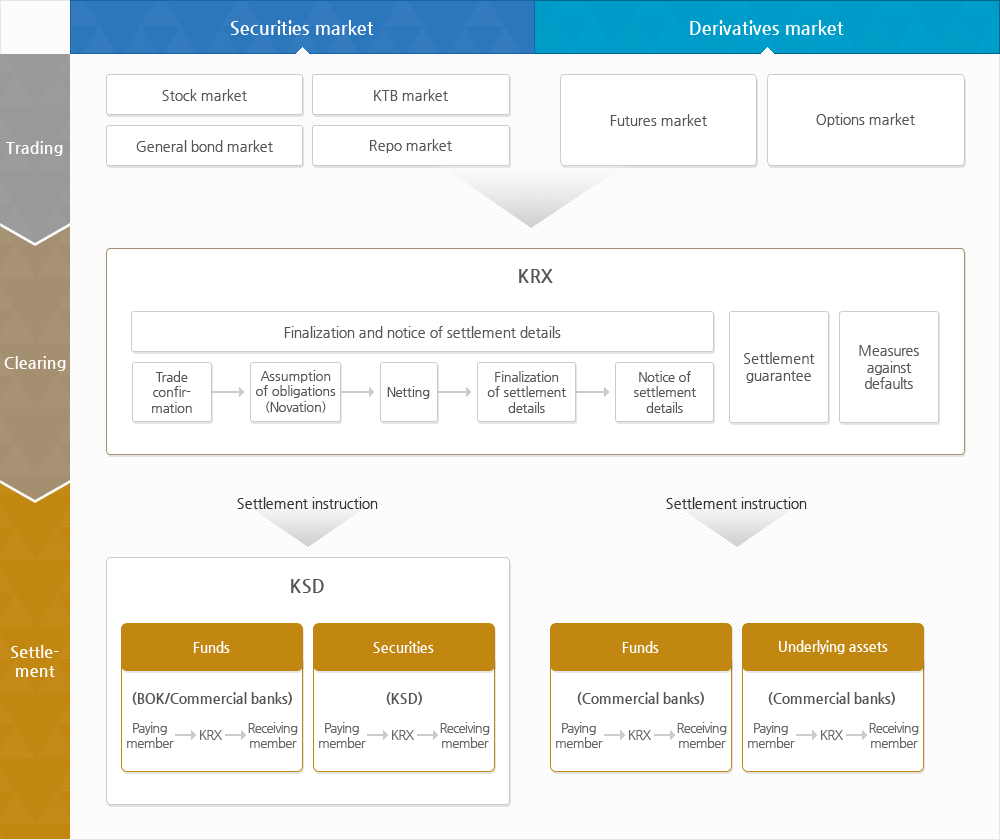

The Korea Exchange (KRX) provides trading venues for both securities and derivatives products, and at the same time, it takes up the role of the Central Counterparty (CCP) in charge of implementation of settlement subsequent to the execution of transactions. That is, the KRX adopts an in-house system in which the Exchange acts as a clearing and settlement organization as well as a trading venue.

- Features of Settlement in Securities and Derivatives Markets

-

Settlement in general means closing out of a deal by fulfilling or compensating the obligation of a seller to transfer the concerned property and the obligation of a buyer to make the payment for the trade, both of which are occurred by a trade contract.

As trades in the securities and derivatives markets are made anonymously in a mass and collectively and repeatedly, the settlement method used in general business transactions would require market participants to prepare a huge amount of funds and securities, which would result in a tremendous administration cost and also raise questions on the confidence and credibility on the deal closing. In addition, if any transaction fails to settle, the whole transactions at the securities and derivatives markets will become unstable.

As such, the market needs highly standardized settlement procedures and risk management mechanism to secure the reliable and speedy settlement. The KRX that launched the markets and plays the role of counterparty in all transactions designed and has operated the procedure on clearing and settlement and method how to deal with settlement defaults.

< Clearing and Settlement Process >