- Overview of the Emissions Market

-

- Progress of the Emissions Trading Scheme in Korea

-

- 1. Kyoto Protocol took effect (Feb. 2005)

- 2. The national target for greenhouse gas reduction was set (Nov. 2009)

- 3. Framework Act on Low Carbon Green Growth was enacted (Jan. 2010)

- 4. Emissions Trading Act was enacted (May 2012)

- 5. The KRX was named as the venue for emissions trading in Korea (Jan. 2014)

- 6. The trading of emissions permits commenced (Jan. 2015)

- ① With the effect of Kyoto Protocol, the emissions trading market expanded mainly in the EU.

- ② The Korean government finalized the “Vision for New Growth Engine and Development Strategies” (Jan. 2009) and set a greenhouse gas reduction target based on the results of the analysis conducted jointly by national research institutions.

- ③ A ground to adopt Cap & Trade was laid following the enactment of Framework Act on Low Carbon Green Growth.

- ④ A trading mechanism was materialized with the establishment of the Act on the allocation and Trading of Greenhouse Gas Emissions Permits (May 2012)

- Formulates basic principles such as utilization of market practice, fair/transparent transaction and cooperation with the international community, and specifies the details on membership, transaction method, clearing/settlement, information disclosure and market monitoring.

- ⑤ The government designated KRX as the Exchange for emissions trading (Jan. 2014)

- ⑥ The KRX launched the emissions permits market (Jan. 2015)

< Regulations related to the Operation of the Emissions Market > Operation of emissions permits exchange

(§22② of the Act)Businesses of the emissions permits exchange

(§27 of the Enforcement Decree of the Act)Members Launching and operation of the market Trading method Competitive trading and auction (for allocation of allowance) Clearing/settlement Confirmation of trades, assumption of liability, netting, finalization of settlement details, settlement guarantee, handling of settlement failures, settlement instructions Dissemination of trading Information Best bid and offer, opening/highest/lowest/closing prices, market price are publicly announced on a real-time basis. Market surveillance Monitoring/Inspection on abnormal trading activities Dispute Mediation Mediation of trading disputes upon application Businesses of members in the market Matters regarding the receipt of customer orders

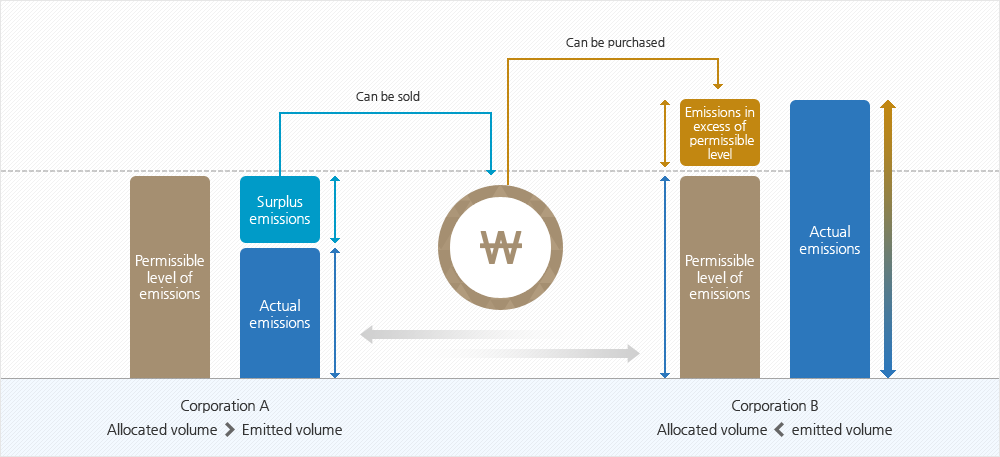

- Concept of the Emissions Trading Scheme

-

- Each company is allowed to emit greenhouse gases within the limit of allocated emissions permits and to trade any surplus or shortage with other companies.

- Companies may reduce the emissions by themselves or buy the emissions permits directly in the market in order to fulfill the permissible level of emissions depending on the cost for greenhouse gas reduction.