- Execution of Trading Contract

-

Bid quotations for the specified issue in the AQRT Table compete with ask quotations for the same issue while bid quotations for an unspecified issue (General quotations) compete with ask quotations for all issues. A trade is executed in continous auction (multiple price auction) by the type in the AQRT Table.

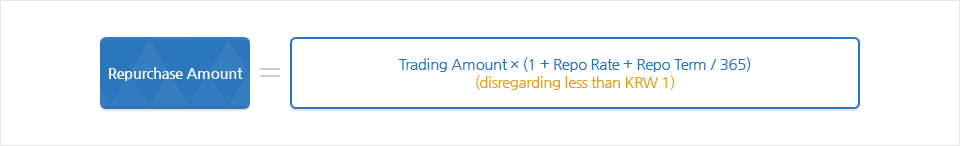

- Trading amount

-

The trading amount that the buyer pays to the seller for the bonds is calculated based on the formula below:

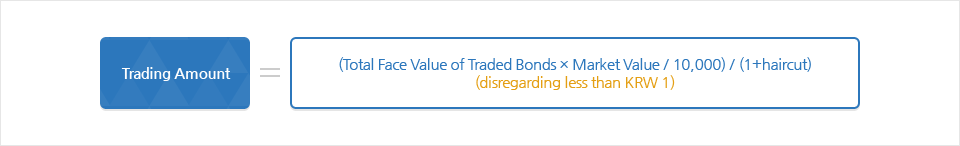

- Repurchase amount

-

The repurchase amount that the seller pays to the buyer on the repurchase date is calculated based on the formula below: