- Background

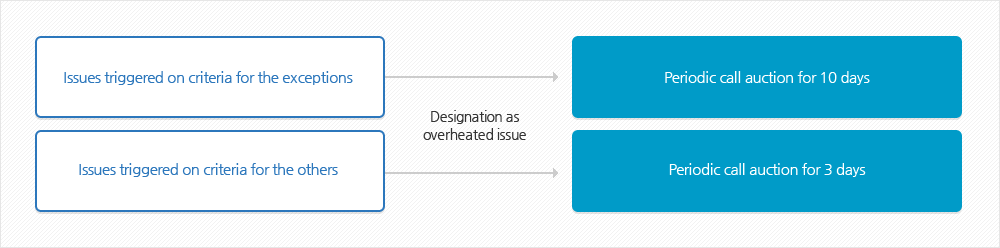

- In November 2012, KRX adopted a set of institutional arrangements to ease temporary overheat in the market, in a bid to curb excessive volatility and unfair trades, and thus facilitate the price discovery function.

- Triggering criteria for the exceptions

-

- If a listed stock (including KDRs) falls under any of the followings, the arrangements are executed on the next day of occurrence and it continues for 10 trading days - periodic call auction for 10 days

-

- Case where the number of free floating shares is less than 300,000 or 5% of the listed shares while designated as administrative issue or investment alert issue.

- Case where the trading of the stock resumed in 6 months after more than 30 business days due to capital reduction, reverse split of the stocks, capital increase or reduction during the rehabilitation procedure.

- Case where the number of any different classes of stocks is less than 100,000 or designated as administrative issue.

< Triggering criteria based on the temporary overheat indicators > Temporary overheat indicators Prior notice on triggering A prior triggering notice is issued when an issue comes under any of the followings for the first time.

- (Stock price) The closing price of the day is 30% or higher than the average closing price for previous 40 trading days.

- (Turnover) The average turnover ratio of recent 2 days is 500% or higher than the average turnover of previous 40 trading days.

- (Volatility) The average volatility of recent 2 days is 50% or higher than the average volatility of previous 40 trading days.

Triggering The institutional arrangements to ease temporary overheat are implemented when an issue is detected again within 10 trading days from the date of prior triggering notice. - Triggering criteria for the others

-

- If a listed stock (including KDRs) falls under the following case, the institutional arrangement is implemented on the next day of occurrence and it continues for 3 business days; periodic call auction for 3 days.

-

- Case where it was detected by the temporary overheat indicators (please see the table below) on stock prices, turnover, and volatility for 3 times during a certain period of time.

< Triggering criteria based on the temporary overheat indicators > Temporary overheat indicators Prior notice on triggering A prior triggering notice is issued when an issue comes under all of the followings 3 criteria once again with 10 days after the day when it was detected for the first time.

- (Stock price) The closing price of the day is 30% or higher than the average closing price for previous 40 trading days.

- (Turnover) The average turnover ratio of recent 2 days is 500% or higher than the average turnover of previous 40 trading days.

- (Volatility) The average volatility of recent 2 days is 50% or higher than the average volatility of previous 40 trading days.

Triggering The institutional arrangements to ease temporary overheat are implemented when an issue is detected again within 10 trading days from the date of prior triggering notice. - Criteria for Release from Designation as Temporary Overheated Issues

-

The designation is released automatically the day after the triggering period.

The triggering period can be extended by 3(or 10) trading days when the closing price on the last day of triggering period is 20% or higher than the closing price of the day before the execution.

-

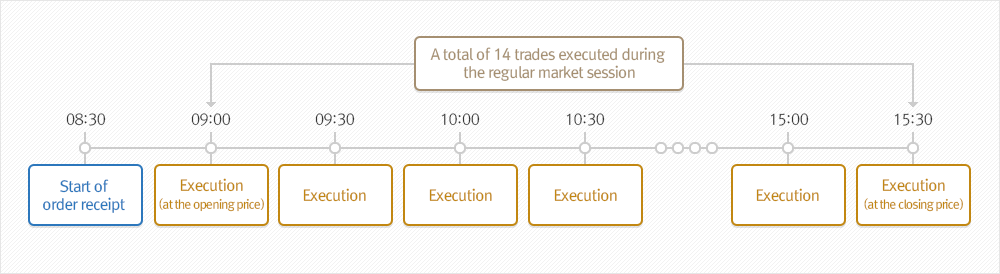

- Whta is the single-price trading method at every 30 minutes?

-

- (Execution method for single-price trading) Rather than trading immediately after investors’ orders, single-price trading is a method that allows trading at all once at an equilibrium price to allow the most trades to take place after collecting orders over a certain period of time. It is currently applied to determine opening and closing prices.

- Namely, if a measure to alleviate short-term overheating is taken, trades are executed every 30 minutes after 09:00 (the hours of trading for price quotation) during the regular market session (09:00-15:30). In this case, only limit orders, market orders, and competitive block trading orders are allowed to submit the quote, and limit orders and market orders are not allowed to enter Immediate or Cancel (IOC) orders and Fill or Kill (FOK) orders.

- Trading during off-hours trading sessions (the pre- and post-market sessions) and block trading, basket trading, and competitive block trading during the regular market session are executed normally.