- Background

-

KRX has adopted the measures to ease temporary overheat’ in the market since November 5, 2012 to curb excessive volatility and unfair trades, and thus promote efficient price discovery.

- Triggering criteria

-

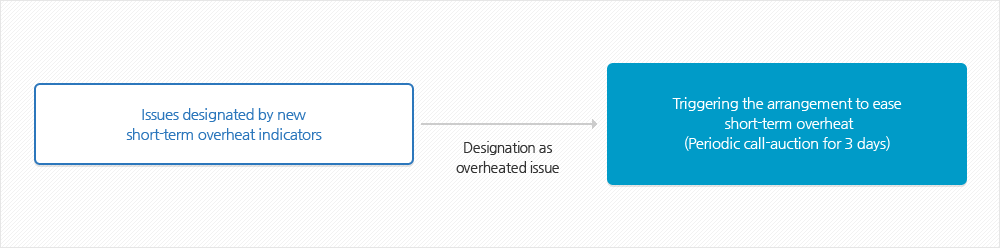

If a listed stock (including KDRs) falls under the following case, the measure is executed on the next day of occurrence and it continues for 3 business days; periodic call auction for 3 days.

- Case where it was detected by the temporary overheat indicators (please see the table below) on stock prices, turnover, and volatility for 3 times during a certain period.

< Triggering criteria based on the temporary overheat indicators > Temporary overheat indicators Prior Notice on Triggering A prior triggering notice is issued when an issue comes undermeets all of the following 3 criteria once again within 10 trading days after the day when it was detected for the first time.

- (Stock price) The closing price of the day is 30% or higher than the average closing price for previous 40 trading days.

- (Turnover) The average turnover ratio of recent 2 days is 500% or higher than the average turnover of previous 40 days.

- (Volatility) The average volatility of recent 2 days is 50% or higher than the average volatility of previous 40 days.

Triggering The measures for temporary overheat are triggered if an issue detected by the criteria again within 10 trading days from the prior triggering notice day.