- Publication of Quotation Information

-

In order to enhance efficiency of price discovery function in the market and support investment decision-making, service of securities companies, the KRX publishes the details of quotation information to all the participants on real time basis during quotation receiving hour.

The range of publication of quotation information is following;

-

Continuous auction

- the prices of 10 successive best per bid and offer respectively, including the best bid and offer

- the quantities at such prices

- the total of such quantities per bid and offer respectively

-

Periodic call auction

- the prices of 3 successive best per bid and offer respectively, including the best bid and offer

- the quantities at such prices

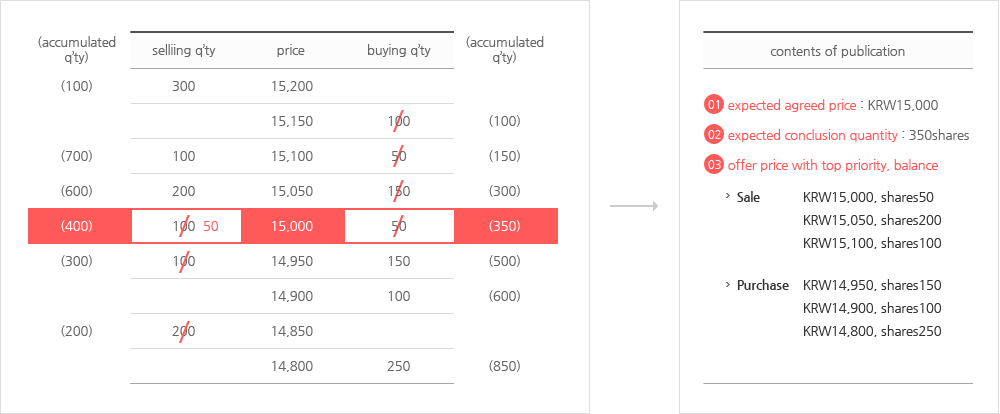

- the expected matching price and quantity

During the quotation receiving hours for the determination of opening price(8:30~9:00), such information shall be published after 8:40, when 10 minutes have elapsed from the beginning of the quotation receiving hour.

- example : provision of information on 10 stage offer price per selling/buying

-

주의As of January 2, 2002, abolition was made for publication of quantity for total offer price in continuous auction and expansion was made to 10 stage preferential offer price.

example : provision of information on 10 stage offer price per selling/buying balance of selling price balance of buying 3,000 11,050 500 11,000 400 10,950 2,400 10,900 700 10,850 950 10,800 1,000 10,750 900 10,700 2,100 10,650 90 10,600 10,550 1,040 10,500 3,000 10,450 250 10,400 2,500 10,350 900 10,300 3,040 10,250 300 10,200 3,220 10,150 2,000 10,100 3,750 12,040 합계 20,000 - example : provision of information on offer price like expected agreed price

-

주의As of September 30, 2002, it was enforced that publication of quantity for total offer price in periodic call auction was abolished and publication of expected agreed price was allowed.

주의As of September 30, 2002, it was enforced that publication of quantity for total offer price in periodic call auction was abolished and publication of expected agreed price was allowed.

-

Continuous auction