- Program trading

-

Program trading generally means such a trading technique through computer as processes market analysis, judgment of investment timing and order submission; establishing investment strategy per market situations in advance, programming it by computer, and computer-processing analysis of market situations and orders as per analysis outcome.

Program trading in Korean market has two kinds, i.e. all the index profit trading and non-index profit trading through which the same person concurrently makes a trading of more than KOSPI 15 items.

The index profit trading means the one conducted by linking stock group with futures or options for the purpose of getting profit through price difference between stock group of KOSPI 200 and KOSPI 200 futures or options. It is not required for trading time for futures or options to be same so that it is possible to buy futures or options first and then sell stock group in sequence or vice versa.

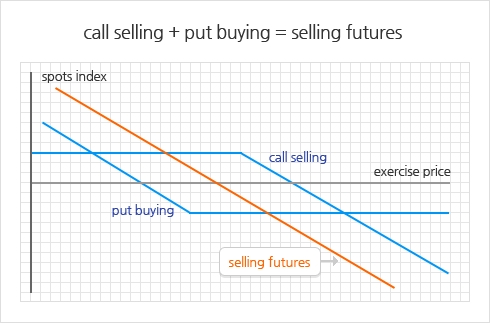

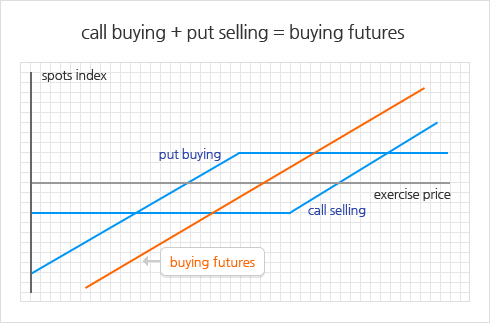

According to prevailing regulation, index profit trading includes; ① simultaneous trading of buying stock group and selling index futures item ② simultaneous trading of selling stock group and buying index futures item ③ trading of selling (buying) index futures item after buying (selling) stock group ④ trading of selling (buying) stock group after buying (selling) index futures item. Meanwhile, selling index futures item includes selling index composition futures (trading of selling call option and buying put option), buying index futures items includes buying index composition futures (trading of buying call option and selling put option).

- Sidecar for program trading

-

- Sidecar for program trading

-

As the most typical means to regulate program trading, this sidecar system is to ease the shock on the stock market through temporary restriction on validity of offer price when the market situations make sudden change.

If price of basic item in futures market increases or decreases more than 5% comparing to basic price continuously for 1 minute, this system shall suspend for 5 minutes validity of offer price of program buying in case of increase and that of program selling in case of decrease, and then trading shall be executed according to receiving sequence after the validity of program trading has been suspended for the said 5 minutes. Also, if price of basic item increases or decreases more than 5% comparing to basic price, an advance notice shall be made that validity of offer price for program buying/selling may be suspended.

It is provided to revoke exercise of sidecar since 40 minutes before market closing and when corresponding trading is resumed after suspension of trading in stock market by Circuit Breakers during the abovementioned suspension time.