- Ex-dividends

-

Ex-dividends are a market notification that investors buying ex-dividend shares are not entitled to receive forthcoming dividends from the concerned company. Usually, listed companies designate the last business day of the fiscal year as confirmation date to finalize the list of shareholders who will exercise shareholders’ rights at the general shareholders meeting. Then, the shareholders newly owning the shares after the closing of the fiscal year will not have the right to receive the dividends from the previous business year's closing. Therefore, the KRX takes ex-dividend measures from the ex-dividend date so that the stocks are priced reasonably.

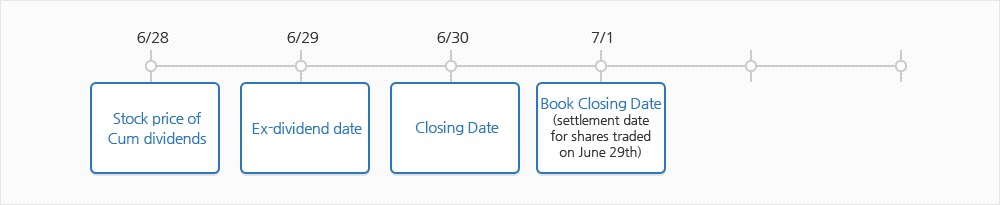

As regular-way transactions are settled on the 3rd business day (T+2), ex-dividend is made from the stocks traded on the day prior to the last business day, of which stocks are settled on the Book Closure Date, which is the next day of the last business day of the fiscal year.

< Example: Ex-dividends for End-of-June Closing Companies >

- Ex-rights

-

Ex-rights are a classification of shares indicating that investors buying the shares are not entitled to shares from a forthcoming rights issue of the company concerned. Ex-right dates are determined as the same way as the Ex-dividend dates, considering the settlement period of T+2, so that the stock is priced reasonably. Therefore, the ex-right date is the day prior to the Book Closure Date. As such, investors who bought the shares 2 days before the book closing date (cum right) are entitled to shares from rights issue.