- Definition

-

- Synthetic ETFs

-

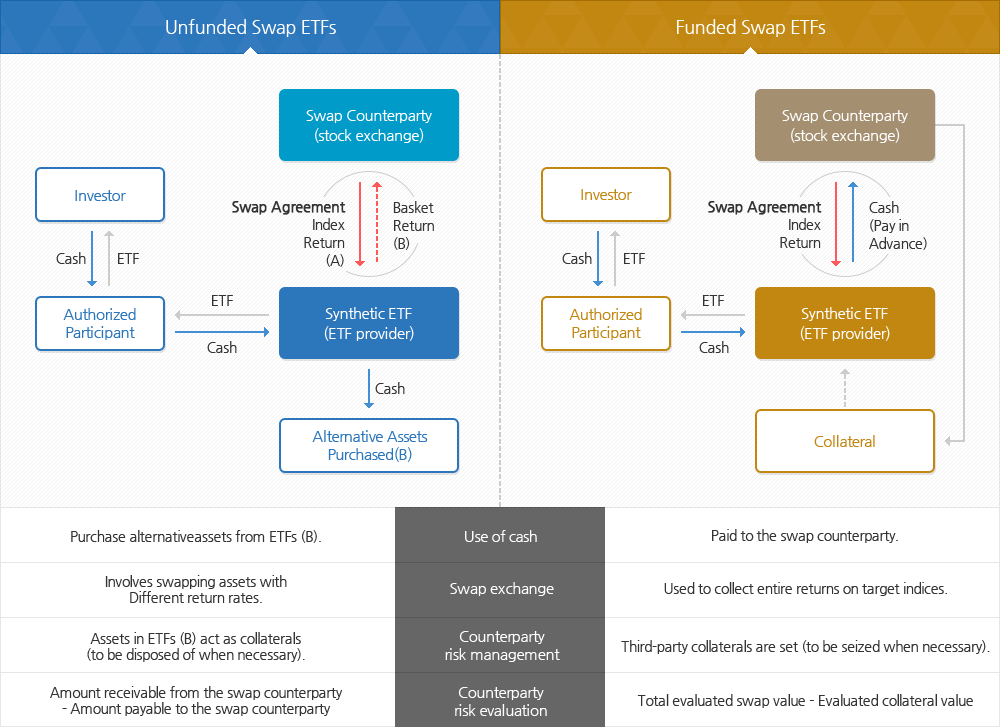

Unlike physical ETFs that hold securities, synthetic ETFs replicate and track underlying exchange indices through OTC swap. According to the swap agreement, the swap counterparty promises to perform at the given underlying index’s return rate, while the ETF provider manages the counterparty’s risks and other factors. Depending on whether the ETF provider collateralizes assets or not, synthetic ETFs are divided between funded swap types and unfunded swap types. The latter type directly purchases and owns assets with the investment fund instead of providing collaterals.

< Structures and Characteristics of Synthetic ETFs >

- Unfunded Swap ETFs

-

The ETF provider utilizes the investors’ cash to purchase alternative assets (B) and linked to them to the given ETF. The ETF provider then swaps the return rate on the ETF-linked assets (B) with the swap counterparty’s target index return rate (A).

The ETF provider realizes the ETF-linked assets to return investments to investors should the swap counterparty become bankrupt or insolvent. This type of ETFs therefore can significantly reduce counterparty risks

- Funded Swap ETFs

-

The ETF provider provides the investors’ cash to the swap counterparty pursuant to the swap agreement, which requires the counterparty to return the principal and interests according to the underlying index return rate in the future.

The ETF provider sets up a collateral for the fund provided for the swap counterparty in an attempt to control counterparty risks. Yet this type of ETFs may leave some risks unattended, as the ETF provider may experience limits seizing and disposing of the collateral should the counterparty become bankrupt or otherwise insolvent.